Latest Industry News

Senior Decision Makers in finance and accounting admit to not being the best at keeping receipts, as 65% confess to having lost them, according to a new YouGov poll out today.

The poll run by YouGov for HM Revenue and Customs (HMRC) also found that 92% of senior decision makers personally bank online, almost two thirds (62%) support all tax accounts being digitalised and one in four (25%) working in a small business are spending over 10 hours a week on administrative tasks.

HMRC is inviting businesses to reduce time spent on paperwork and join its digital revolution by testing the new Making Tax Digital service for submitting VAT returns.

Most businesses above the VAT threshold will need to keep their records digitally and submit their VAT return using compatible software when Making Tax Digital is introduced for periods starting on or after 1 April 2019.

In practice, the vast majority of businesses won’t need to send their first Making Tax Digital return until August at the earliest, but if they aren’t already keeping their records digitally they will need to start doing so. HMRC are encouraging more businesses to get involved early by getting software and starting to test the service now.

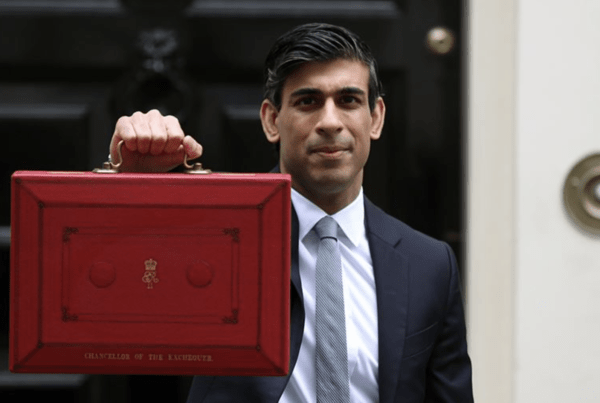

Mel Stride, Financial Secretary to the Treasury, said:

Anything that helps businesses to manage their tax more easily so they can focus on what they do best – innovating, expanding, and creating jobs and profits – is what every modern business needs. In a world where customers and suppliers are already banking, paying bills and shopping online, it makes sense for HMRC and businesses to bring tax affairs fully into the 21st century.

Going digital with business records and taxes is the next step to businesses getting more control over their business and their finances.

Mel Stride MP on Making Tax Digital

Theresa Middleton, Director of the Making Tax Digital for Business Programme, said:

There is no change to ‘what’ information is provided through Making Tax Digital, just ‘how’ it is recorded, generated and provided. We want to help businesses be ready for the changes which kick in for VAT periods which start on or after 1 April.

We’ll have written to every business required to join this year by the end of February, but even back in December over 80% of them were aware of the changes they need to make and the vast majority of those are already preparing. More than 16,500 businesses have already signed up to do their VAT digitally – why don’t you join them?

Richard Balson of R J Balson & Son Butchers based in Bridport, Dorset:

As the oldest family butchers in Britain we have moved with the times since 1515, balancing the traditional with the modern. Making Tax Digital is an example of that progression and we are happy to be digitising our records to make the switch to digital as part of the Making Tax Digital pilot.

For most businesses their accountant or other tax representative will already be aware and will advise them how and when they need to make changes to be ready for the new service. Those already using software will simply need to ensure it’s Making Tax Digital compatible before joining the new service. For those who are not using an accountant though, it is quick and easy to sign-up and there is lots of information available to help them prepare, including about what software is available.

What businesses need to do

-

Take steps to find out if your business is affected by the Making Tax Digital changes and what you need to do if it is – most businesses above the VAT threshold have to start keeping their records digitally and sending their VAT return to HMRC direct from their software for VAT periods starting on or after 1 April

-

Talk to your accountant or other agent – if you use one to manage your VAT affairs – about how they are making returns Making Tax Digital compliant

-

Speak to your software provider if you already use software to ensure it will be compatible

-

If you’re either not represented by an accountant, and/or do not already use software, you’ll need to select software to use and sign-up to Making Tax Digital – our GOV.UK webpages provide information on a wide variety of products, from free software for businesses with more straightforward tax affairs, to increasingly sophisticated paid solutions. There are also products that can be used in conjunction with a spreadsheet for those businesses who don’t want to change their underlying record keeping system.

Easy to use guides for businesses, agents and others including easy-to-follow advice are available on GOV.UK.

Webinars and videos for Making Tax Digital are also available.

Making Tax Digital is part of the government’s #Smartergov campaign which was launched to drive innovation through the public sector.

Further information

-

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1,042 adults. Fieldwork was undertaken from 28th January – 5th February 2019. The survey was carried out online. The figures have been weighted and are representative of British business size.

-

HMRC recognises that businesses will require time to become familiar with the new requirements of Making Tax Digital. HMRC has been clear that during the first year of mandation, they will take a light touch approach to digital record keeping and filing penalties where businesses are doing their best to comply with the law. But this does not mean a blanket ‘no penalties promise’.

-

No business will be forced to go digital for their VAT returns if they are unable to. Anyone who is already exempt from online filing of VAT will remain so under Making Tax Digital and there is further provision for those who cannot adapt to the new service due to age, disability, location or religion to apply for an exemption.

-

Those businesses that are registered for VAT but are below the VAT threshold are also not required to use the Making Tax Digital service, but can choose to do so.

-

Follow HMRC’s Press Office on Twitter @HMRCpressoffice

This article contains public sector information licensed under the Open Government Licence v3.0. This article first appeared on the Gov.uk website. View the original article HERE.

For tailored advice on how to best manage your personal and business finances, get in touch with us today and find out about how CBHC can help you do more with your money.